Table of Contents

Yes, you can run more than one Comparison Shopping Service (CSS) for the same Merchant Center in the EU. Done right, multiple CSS can expand auction coverage, steady CPCs in competitive categories, and give you sharper control over feed and reporting. Done badly, it creates noise, overlap, and higher ops cost. This guide shows when to stick with one CSS, when to add another, and how to run a clean multi-CSS setup.

Audit your ads for free

TL;DR

- Multiple CSS can increase visibility and sometimes CPC efficiency, but only with clear ownership of the feed and budgets.

- Start with one CSS. Add a second when you’ve plateaued on impression share or need advanced feed tooling.

- Segment by category/market/margin tier; don’t let two CSS touch the same feed fields.

- Standardize tracking and audit auctions weekly.

- Keep PMax and Shopping in sync—fix your foundations with Shopping best practices and How to create a Shopping feed.

1. What “multiple CSS” actually means

In the EU, Shopping ads must run via a CSS—Google’s CSS or an alternative partner. “Multiple CSS” means more than one CSS participating in auctions for your catalog. You still own the Merchant Center; each CSS can bid on your products based on the association and scope you define. For fundamentals, see our Google Shopping hub.

2. When one CSS is enough

- You’re early stage and need simplicity.

- Low-competition niche; impression share isn’t your bottleneck.

- Limited ops capacity to govern feeds, labels, and partner rules.

- You haven’t yet nailed the basics: feed quality, titles/attributes, disapprovals. Start here: Google Shopping best practices

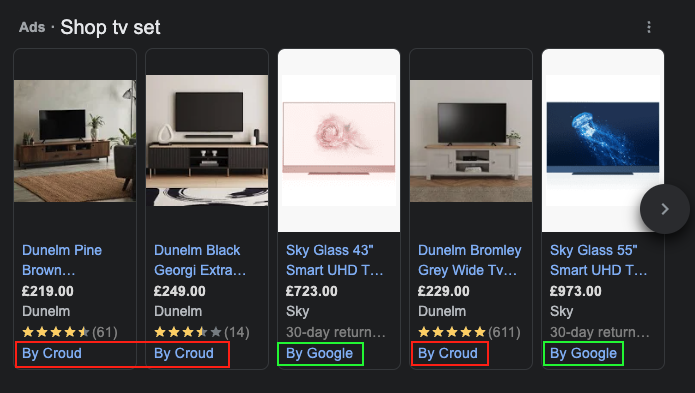

- Red—an example of using alternative/multiple CSSs for increased presence on search results in the same auction.

- Green—search results from Google Shopping as a CSS.

3. When multiple CSS makes sense

- You’ve plateaued on impression share or marginal CPC gains with one CSS.

- You need tooling beyond Google’s defaults: title rewriting, attribute rules, custom labels by margin, deeper diagnostics.

- You want controlled A/B at the category or market level (not overlapping the same SKUs).

- You operate across several EU markets with different competitive dynamics.

4. The upside: why advertisers add a second CSS

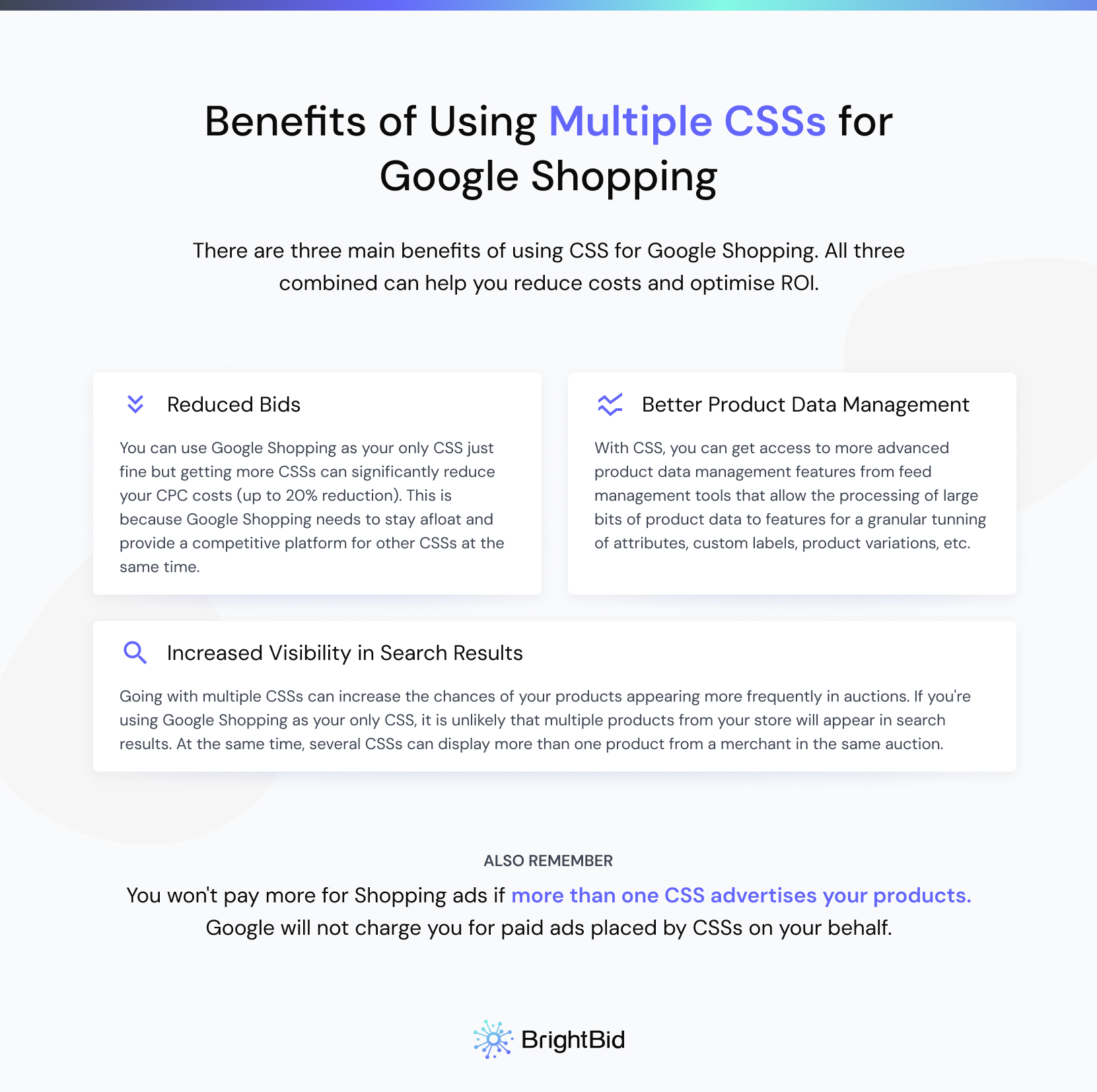

- Increased visibility. Better chance to surface more than one product in the same auction for a given query.

- Potential CPC efficiency. Alternative setups can yield more stable effective CPCs in competitive verticals.

- Audience reach. Different partners tap different demand sources and niches.

- A/B partner testing. Compare bidding/merchandising by category or margin tier.

- Deeper insights. Extra reporting on product/category performance and competitive posture.

- Better governance. Some partners bring stronger feed ops—bulk rules, attribute tuning, labeling.

5. The downside: what breaks in practice

- Complexity. More vendors = more QA on feeds, exclusions, and budgets.

- Cost. Extra platform/management fees if you don’t negotiate scope clearly.

- Conflicting tactics. Divergent bid and label rules can fight each other.

- Attribution fog. Without naming/UTMs, credit gets muddy across partners.

- Duplicate edits. Two CSS changing the same fields creates drift and disapprovals.

6. Governance: how to avoid cannibalization

- Assign a feed owner. One party controls titles, attributes, suppression rules, and custom labels.

- Segment scope. Split by category/brand/market/margin. No overlapping edit rights.

- Name and track. Enforce naming/UTMs per CSS, per market, per category.

- Budget caps. Define per-CSS and per-category caps; review weekly.

- Auction checks. Monitor Auction Insights and Diagnostics; suppress low-margin SKUs quickly.

- Keep PMax tidy. If PMax blends branded and generic demand, fix it before adding partners:

7. Setup playbook (clean and fast)

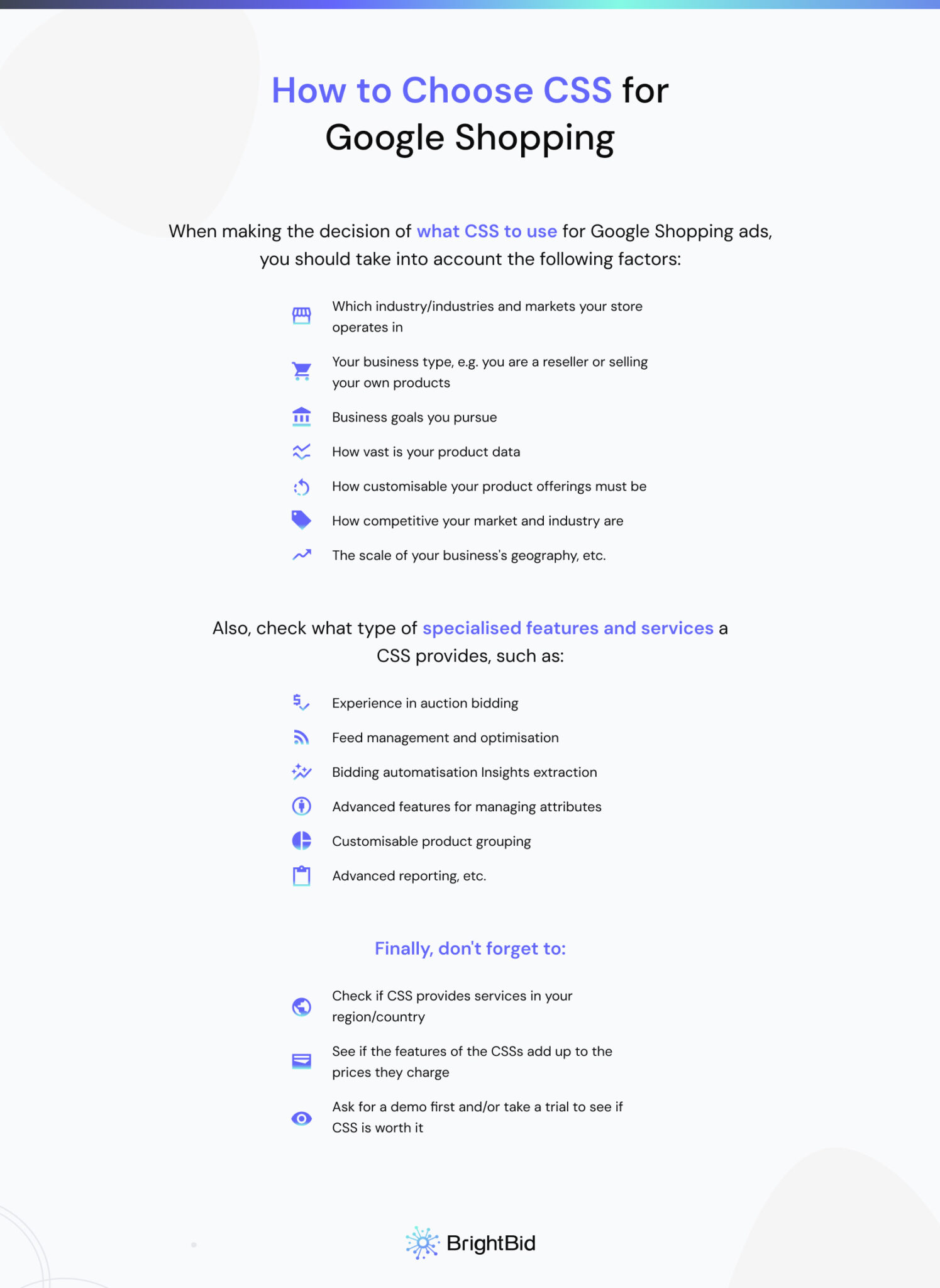

- Pick your second CSS based on markets covered, feed tooling, reporting depth, contract model, and SLAs.

- Associate Merchant Center with the new CSS while keeping account ownership clear.

- Define scope (e.g., DE + Home Appliances only; or High-margin SKUs only).

- Lock feed ownership: who edits titles/attributes/labels; who can suppress SKUs.

- Tracking standards: campaign names, product group names, UTMs per CSS.

- Stage & test: confirm Diagnostics clean; check auction overlap before scaling.

- Scale gradually; review CPC/Impr share/COS by category weekly.

8. Pricing models and risk controls

- Retainer, % of media, or performance-based (CPC/CPS).

- Guardrails: data ownership, budget ceilings, SKU suppression rules, negative governance, and a written rollback plan.

- If using PMax heavily, ensure your CSS partner’s reporting can attribute lift rather than blur it—start with Conversion Value Rules explained.

9. BrightBid CSS and tools

BrightBid combines CSS with tools for feed optimization, automatic title rewriting, AI bidding, and PMax-aware insights—useful when governance matters as much as scale. Explore:

- All Features

- Google Shopping hub

- Shopping best practices

- Create a Shopping feed

- Analyze PMax

- Exclude products from PMax

Audit your ads for free

10. FAQ

Does using multiple CSS increase my click costs?

Not inherently. Running more than one CSS does not mean you pay twice for the same click. In some categories, a second CSS can help stabilize effective CPCs.

Can multiple CSS show more of my products in the same auction?

Often, yes—especially across larger catalogs. That’s the main visibility play.

What’s the biggest risk with multi-CSS?

Governance. If two partners touch the same feed fields or budgets, results degrade fast. Assign one feed owner and segment scope.

Will multi-CSS fix a weak feed?

No. Fix the foundation first—Brand/GTIN/MPN, titles, attributes, and clean Diagnostics—using the guides linked above.

How do I measure real lift?

Track by category/market with consistent naming/UTMs, audit auctions weekly, and compare CPC/Impr share/COS pre vs post. Align with PMax reporting so you don’t double-count.

11. Final take

Add a second CSS when you’ve earned it. One CSS + a strong feed gets you most of the way. Add another when you need more coverage or steadier CPCs—and only with strict ownership of labels, budgets, and auctions. Keep PMax aligned, measure at the category level, and cut overlap fast. That’s how multi-CSS becomes leverage, not chaos.

” />

” />

” />

” />

” />

” />

” />

” />

” />

” />

” />

” />